Do you recognise any of these logos? Chances are, at least one of them is already a part of your day-to-day life.

From groceries on BigBasket, medicines and lab tests via Tata 1mg, shopping on Tata Cliq, or even flights with Air India, Tata brands power many of our everyday spends.

Now here’s the catch: if you’re spending on any of these Tata brands without applying a few simple tricks I’m about to reveal, you’re likely leaving at least 10-15% cashback on the table, every single time.

What is Tata Neu?

Tata describes Tata Neu as “an app designed to offer customers an extensive yet highly personalised shopping experience.”

Think of it as a loyalty hub that ties together multiple Tata brands and rewards you for spending within the ecosystem.

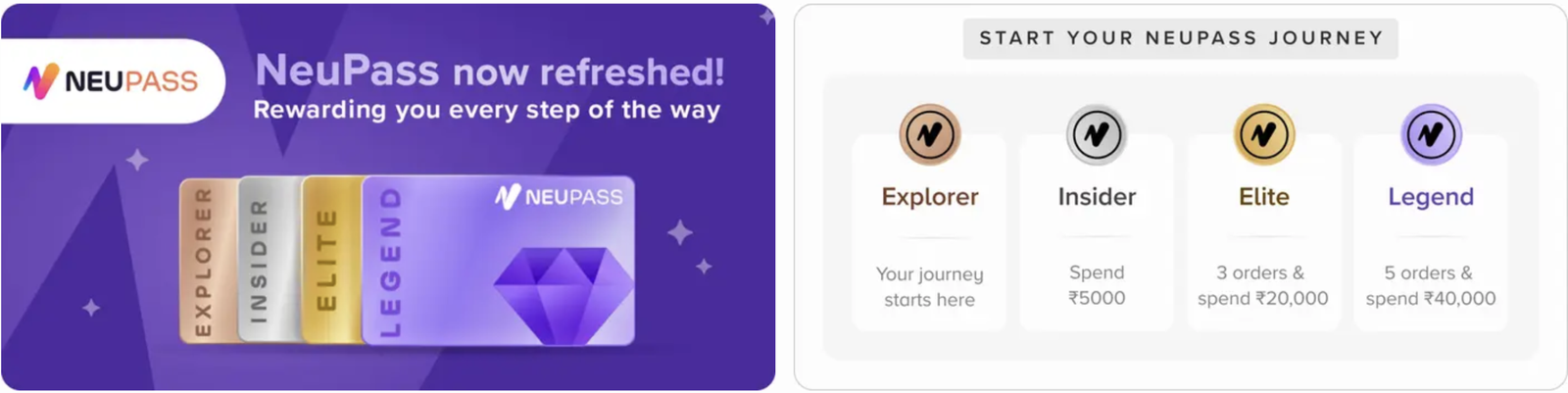

When you join the Tata Neu loyalty program, you’re automatically enrolled into its rewards program called NeuPass.

NeuPass is a tier-based rewards program that lets you earn up to 5% NeuCoins on purchases made across Tata brands when you shop through the Tata Neu app.

Since NeuPass is tied to your mobile number, always use the same number across Tata brands to make sure you don’t miss out on NeuCoins.

Now, you might be wondering—what exactly are NeuCoins?

NeuCoins are the reward currency of the Tata Neu ecosystem. 1 NeuCoin = ₹1, and they can be redeemed only within the Tata Neu platform across Tata brands.

For example, if you book an Air India flight using the Tata Neu app, the NeuCoins you earn can later be used to get groceries, medicines, or shopping for up to 5% of your ticket value, depending on your NeuPass tier.

Now, let’s understand the NeuPass tiers and the benefits associated with each one.

NeuPass is a four-tier, spend-based rewards program, where your tier is determined by the total amount you spend across all Tata brands through the Tata Neu ecosystem.

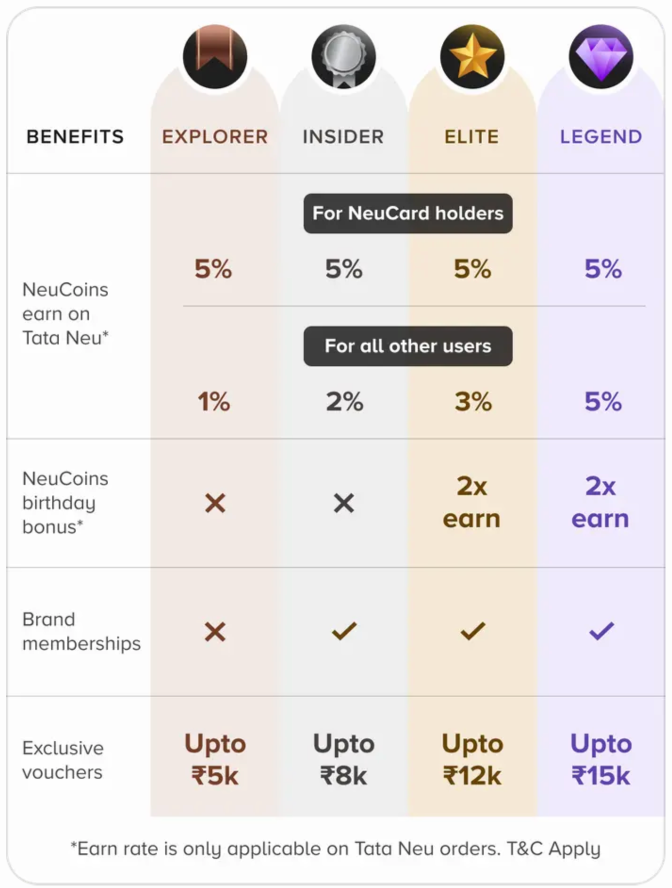

Under NeuPass, the rewards increase as you move up the tiers:

Explorer earns 1% NeuCoins, Insider earns 2%, Elite earns 3%, and Legend earns the maximum 5%.

This means that simply routing your spends through the Tata Neu platform can already reward you with up to 5% back in NeuCoins.

Now let’s take this to the second level.

As you may have noticed in the image earlier, NeuCard holders earn 5% rewards regardless of their NeuPass tier. This effectively fast-tracks you to top-tier rewards even without high cumulative spends.

So, what exactly is NeuCard?

NeuCard : Secret to 10%

This article will focus specifically on the benefits of the NeuCard when used for spending on the Tata Neu platform.

For a detailed breakdown of all NeuCard benefits, including usage beyond Tata Neu ecosystem, you can refer to this 👉 article.

NeuCard is a co-branded credit card offered by Tata Neu in partnership with HDFC Bank, and is specifically designed to maximise rewards on Tata brands.

There are two variants of the NeuCard: NeuCard Plus and NeuCard Infinity.

Both cards instantly unlock the Legend tier under NeuPass, allowing you to earn 5% NeuCoins on Tata brand spends made via the Tata Neu app.

On top of this, these cards offer additional NeuCoins:

- NeuCard Plus: extra 2% NeuCoins

- NeuCard Infinity: extra 5% NeuCoins

This effectively brings the total rewards to 7% with NeuCard Plus and 10% with NeuCard Infinity on Tata brand spends through Tata Neu.

Simply put, by routing your Tata-brand spends through the Tata Neu platform and paying with a NeuCard, you can earn up to 10% back in NeuCoins for future purchases.

To learn more about NeuCard, please refer to this 👉 article.

One Step Further: Secret to 15% and more

So far, you’ve seen how simply changing the way you spend can help you save up to 10%.

Now, let’s take this a step further and look at how you can save even more on your spends.

This next level requires optimising your overall credit card strategy and spending a bit more time on planning and execution. It does involve some effort, but the additional cashback and rewards make it well worth it.

First, pick the credit card that gives you the maximum value for your spending pattern.

Let’s take two simple examples:

- A cashback-focused card like the SBI Cashback Credit Card, which offers a flat 5% cashback on eligible online spends.

- A travel-focused card like Axis Atlas Credit Card, which can deliver around 8% value when rewards are redeemed for Accor stays.

Now, buy gift cards for the Tata brand you plan to spend on.

Platforms like CRED regularly offer discounted Tata-brand vouchers, which helps you save even before you make the actual purchase.

For example, on CRED you can often get:

- BigBasket vouchers at 4-6% discount

- Tata Cliq vouchers at 8-12% discount

- Croma vouchers at 3-5% discount

Once purchased, load these discounted vouchers into your BigBasket, Tata Cliq, or Croma wallet, and use the wallet as the payment method during checkout on the Tata Neu app.

Since Tata Neu app brings many brands under one roof, it can sometimes feel slower than the original brand apps. The best way is to add items to your cart on the original app and switch to Tata Neu only at checkout for payment and rewards.

When you stack everything together: By shopping through the Tata Neu app on Legend tier (5% NeuCoins), combining it with discounted vouchers on CRED, and paying with your preferred credit card, this is how much you earn in terms of NeuCoins, cashback and rewards:

BigBasket purchases

| Axis Atlas Credit Card | SBI Cashback Credit Card |

| 5% NeuCoins (Legend tier) | 5% NeuCoins (Legend tier) |

| 4-6% voucher discount (CRED) | 4-6% voucher discount (CRED) |

| 8% rewards in terms of Accor redemption | 5% cashback on statement credit |

| Total: 17-19% effective savings | Total: 14-16% effective savings |

Tata Cliq purchases

| Axis Atlas Credit Card | SBI Cashback Credit Card |

| 5% NeuCoins (Legend tier) | 5% NeuCoins (Legend tier) |

| 8-12% voucher discount (CRED) | 8-12% voucher discount (CRED) |

| 8% rewards in terms of Accor redemption | 5% cashback on statement credit |

| Total: 21-25% effective savings | Total: 18-22% effective savings |

To get the legend tier immediately, you can get NeuCard and start earning 5% immediately based on your neupass. The card in itself is an excellent card and is worth getting. for detailed review please read this 👉 article.

Hidden Values:

During your birthday month, Tata Neu offers 2× NeuCoins to the Elite and Legend tier members, capped at 200 extra NeuCoins.

This effectively means an additional 5% rewards on spends up to ₹4,000 during your birthday month That is over and above all the rewards you’re already earning.

This benefit is not auto-applied. You must manually enrol for the birthday bonus inside the Tata Neuapp to receive the extra NeuCoins

Tried and Tested:

In this section, I want to share a real-life example of how I made the most of my NeuPass membership.

NeuPass Elite and Legend tiers come with Silver-tier membership of IHCL. This Silver tier offers:

- 20% off room bookings (on the first booking)

- 20% off food and beverages (F&B) at participating IHCL properties

- Plus, 5% NeuCoins on eligible spends

In my case, I missed out on the 20% room booking discount because I didn’t book the stay via Tata Neu. However, I still managed to get 20% off on F&B simply by sharing my NeuPass ID at the hotel.

On top of that, I earned 5% NeuCoins thanks to my NeuPass tier and IHCL Silver status. I paid the entire bill using my Axis Atlas Credit Card, which further earns rewards equivalent to 20% value when redeemed with Accor.

This translated into roughly 40–45% value back. What would normally have been a very heavy bill on the pocket was almost sliced in half, just by optimising credit cards and using a few simple, smart tricks.

Conclusion:

Most of us already make significant spends on Tata brands, often without realising how much value we’re leaving on the table. Tata Neu is a powerful platform that helps you earn meaningful rewards on spends you were already going to make.

If you properly integrate Tata Neu into your overall credit card strategy without changing your lifestyle or increasing your spending, the savings can be substantial. You’re simply optimising how you pay.

To maximise these benefits from day one, you can consider the Tata Neu Infinity Card, which lets you instantly unlock the highest NeuPass tier and earn the best rewards Tata Neu has to offer.

For a detailed and unbiased review of the Tata Neu Card, you can read this 👉 article.