|

Getting your Trinity Audio player ready...

|

This is a masterclass. Expect a comprehensive and detailed article covering basics of Credit Cards.

For every purchase you make, there are multiple payment options available like cash, UPI, debit cards, and credit cards. Cash should always be your least preferred mode of payment, as it offers no rewards or benefits.

There are two ways to pay using UPI: UPI linked to a bank account and UPI linked to a credit card. UPI on a bank account is essentially the same as paying with cash, and we’ll cover UPI on credit cards separately when discussing credit cards in detail in next article.

Debit cards can be a good option in certain situations, especially when they offer 5–10% cashback on specific categories of spends. However, they shouldn’t be your primary payment method.

By default, you should always look to use a credit card as your preferred mode of payment, and in this article, we will explain why.

What is a Credit Card?

A credit card is a financial tool that allows you to take credit from the bank to make payments. Whenever you use a credit card, you are essentially taking a short-term loan, and banks typically offer an interest-free period of 45–50 days to repay it. If you fail to repay the amount within this period, the bank begins charging interest on the outstanding balance.

In this article, we are strictly focusing and promoting the responsible use of credit cards. We will also cover the mistakes you should avoid at all costs to ensure credit cards work in your favour, not against you.

Dealmaker or Dealbreaker

Banks want you to use credit cards, and to encourage this, they offer attractive rewards in the form of cashback or reward points. This naturally raises a logical question: why would banks promote credit cards so aggressively and reward you if they are actually beneficial for you?

To understand this, you first need to understand how banks earn profits from credit cards.

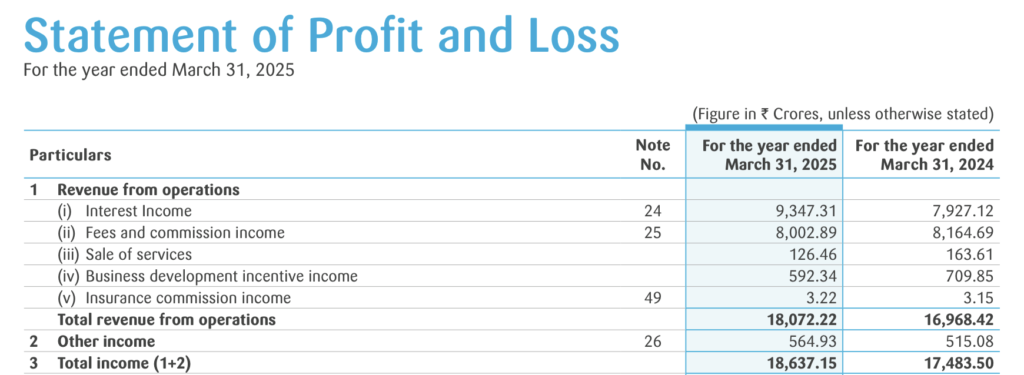

Let’s look at the profit statement of SBI Cards. Nearly 50% of its total revenue comes from interest, which customers end up paying when they don’t settle their credit card bills on time. This brings us to Rule No. 1 of the Credit Card Masterclass: Always, always pay your entire credit card bill in full andon time.

Around 45% of the revenue comes from annual fees and commission in form of Merchant Discount Rate (MDR). MDR (Merchant Discount Rate) is the fee (typically 1.5% to 4% of the transaction amount) that businesses pay to banks for accepting payments made via credit cards. At first glance, you might wonder why merchants would accept credit cards if they have to share a portion of their revenue with the bank.

To understand this, think of two shops on a scorching summer day: one with air conditioning and the other with just a fan or cooler. Which shop do you think would attracts more customers? The same logic applies here. The more payment options a business offers, the easier it becomes for customers to pay and the more sales the business makes. Credit cards also allow customers to spend more than the cash they have in their pocket, which directly benefits businesses by increasing average transaction values.

This brings us to Rule No. 2 of the Credit Card Masterclass: Always, always spend only the amount you would have spent if you were paying in cash.

By now, it should be clear that banks make a significant portion of their profits by encouraging us to use credit cards more, and to overspend. At its core, what they are really selling is a loan, often nudging us to spend more than we otherwise would, with rewards offered as an incentive.

But what if you always spend only what you would have paid with cash and consistently pay your bill within the interest-free period (before the statement due date), never allowing the bank to sell you the loan they are so eager to push?

Congratulations! You’ve unlocked a way to earn rewards on your everyday spending.

By using credit cards responsibly and paying in full every month, you flip the equation in your favour: the bank pays you rewards, while you pay them nothing in interest.

The Hidden Values

1. Rewards in the Form of Cashback and Reward Points

Credit cards reward you either through cashback, which is adjusted against your next statement, or reward points, which can be redeemed for vouchers, travel bookings, or transferred to partner hotels and airlines. The different types of credit cards and how to choose the right one are covered in this article. By using the right credit cards, you can easily get at least 10% value back on your spends and it can go as high as 70% if you are willing to put in the efforts.

2. Brand Offers

Most banks give brand specific offers that provides instant saving of 10-20%.

3. Spend Based Offers

Most banks periodically roll out spend-based offers that can easily fetch an additional 2–5% value back.

4. Interest Free Credit

This value is achievable only when credit cards are used responsibly. Credit cards offer an interest-free period of 45–50 days, allowing you to earn interest on your own money during that time.

Some people may be tempted to take risky decisions, such as investing this money in stocks or trades. But you should be extremely cautious with this approach. It can quickly lead you into the very trap banks want you to fall into.

5. Purchase Protection/ Fraud Protection

Some credit cards also offer Purchase Protection. The Purchase Protection benefit of your Credit Card protects your purchases made with the Card against any theft or accidental damage for a limited period from the date of purchase.

Most Purchase Protection policies typically cover theft to eligible items bought using that credit Card. That means, if you accidentally broke the screen of the new smartphone you bought using your Credit Card recently, your Credit Card company might cover the replacement or repair expenses. There will be a deadline and claim limit, however, as stipulated by your Card provider.

One can file for claims for thefts of eligible items covered under Protection Policy with their Credit Card company. For example, if you bought a laptop using your Credit Card with Purchase Protection feature and it gets stolen within a few days from purchase, you could file a claim for a refund of the money spent. The Credit Card company will need you to submit the original sales receipt, and the police report filed against the theft.

6. Zero Liability / Limited Liability: Fraud Protection

Credit cards also offer zero or limited liability to customers in case of unauthorised transactions, protecting them from fraud.

7. Builds Credit Score

Consistently paying your credit card bills on time helps build a strong credit history and can improve your credit score, which becomes useful when you’re in the market for a low-interest loan. This reinforces Rule No. 1 of our Credit Card Masterclass: Always, always pay your entire credit card bill in full and on time.

Mistakes You Must Avoid at All Costs

1. Always, always pay your entire credit card bill in full and on time.

I can reiterate this endlessly because carrying over your dues can quickly land you in serious debt. Remember, banks earn nearly 50% of their profits from interest. The interest rate on most credit cards is typically in the range of 3–4% per month (Plus GST). One crucial detail that many people overlook is that interest is calculated from the date of the transaction, not from the statement date.

Let’s understand this with an example of a credit card that charges 4% + GST if you carry over your entire dues after the 50-day interest-free period. The billing cycle runs from the 5th of the month to the 4th of the following month, and the statement due date is the 25th of that month.

| Transaction Amount | Date of Transaction | Amount you have to pay before due date (25/02/2025) | Amount to be paid on next statement date (05/03/2025) | Amount to be paid on next statement date (05/04/2025) | Amount to be paid on 6th statement date (05/07/2025) |

| ₹ 1,00,000 | 05/01/2025 | ₹ 1,00,000 | ₹ 1,07,900 + ₹ 1,420 GST = ₹ 1,09,320 | ₹ 1,13,692 + ₹ 2,464 GST = ₹ 1,16,156 | ₹ 1,47,480 |

| ₹ 1,00,000 | 25/01/2025 | ₹ 1,00,000 | ₹ 1,05,260 + ₹ 950 GST = ₹ 1,06,200 | ₹ 1,10,448 + ₹ 1,880 GST = ₹ 1,12,328 | ₹ 1,40,405 |

I have not considered late fees for not paying the minimum due amount to keep things simple, but those too are hefty charges imposed by banks.

As you can see, debt rises very quickly if you don’t pay even the minimum due amount. Additionally, your credit score can drop so sharply that banks may hesitate to consider you for any future credit relationship.

2. Avoid Manufacturing Spends

Don’t manufacture spends just for the sake of reward points. Banks often gamify rewards to make them feel like points on a scoreboard, but remember that you earn only a small percentage in rewards while spending the entire amount. Always use your credit cards for the spends you were going to make anyway. A credit card is a loan, not an extension of your income. Overspending can quickly lead to unmanageable debt accumulation.

3. Cash Withdrawal at ATMs

Cash withdrawal from ATMs using a credit card is the most expensive form of cash you can get. The cash advance fee typically ranges from 3–5%, with a minimum charge of ₹250–₹500 per transaction. On top of that, interest starts accruing from the very day of withdrawal.

4. Non-Personal Use

Allowing friends to pay for their expenses using your credit card in pursuit of reward points can be risky. Banks may flag such transactions as non-personal use, freeze your reward points, and in some cases, even blacklist you from their products.

5. Not Reading Terms and Conditions

Always read the terms and conditions carefully and understand which types of spends attract additional charges. For example, some banks levy a surcharge on fuel transactions, while others waive the surcharge but you may still end up paying GST on it. Staying aware of these details helps you avoid unpleasant surprises.

Final Verdict

While routing your spends through credit cards may seem like a lot of effort at first, it’s absolutely worth it. Initially, you might feel that it requires significant time and attention, but as long as you remember the mistakes to avoid, you’ll only end up saving more and getting greater value from your money.

How much additional value you extract does depend on the effort you’re willing to put in. It may take some time to figure out what works best for you, or you can always consult an expert to speed things up. When used correctly as a financial tool, credit cards can deliver massive savings, often at least 15–20% annually.