|

Getting your Trinity Audio player ready...

|

No Cost EMI (Equated Monthly Installment) is a payment option that allows you to purchase an item by paying the total price in equal monthly instalments without any interest. In such cases, the interest component is effectively covered by the seller through an upfront discount.

On the surface, this may look like a very lucrative offer, especially when combined with additional discounts. But what do the calculations actually reveal? What is the real cost of a No Cost EMI transaction?

Let’s see how no cost EMI works through an example:

Complete Analysis:

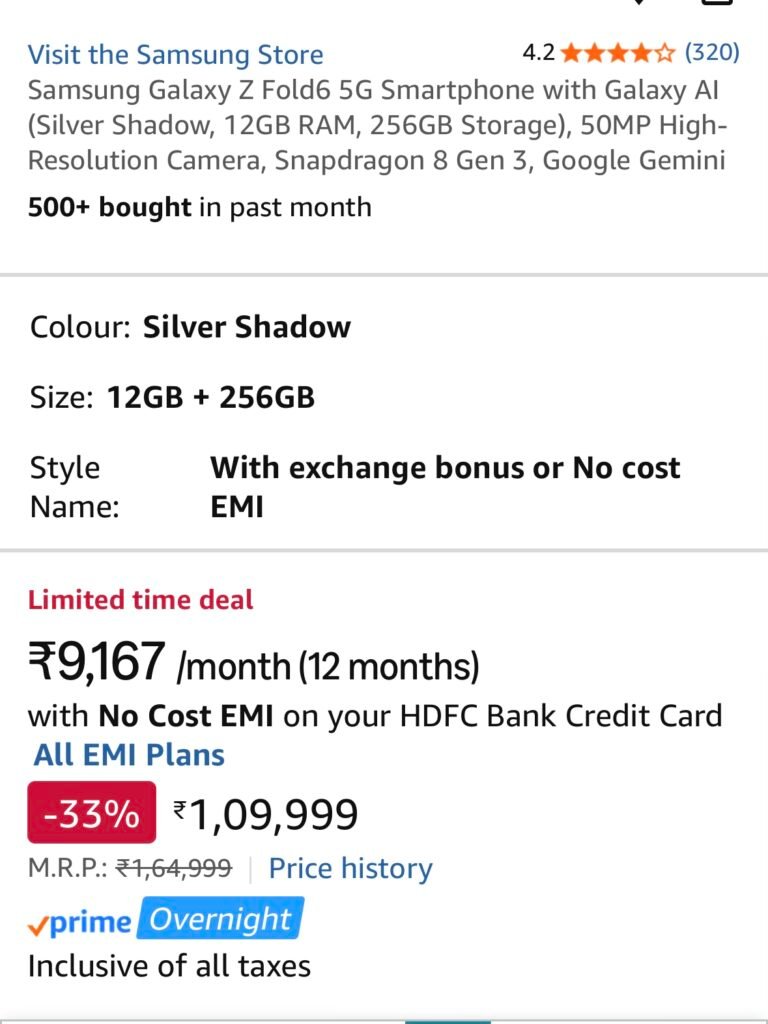

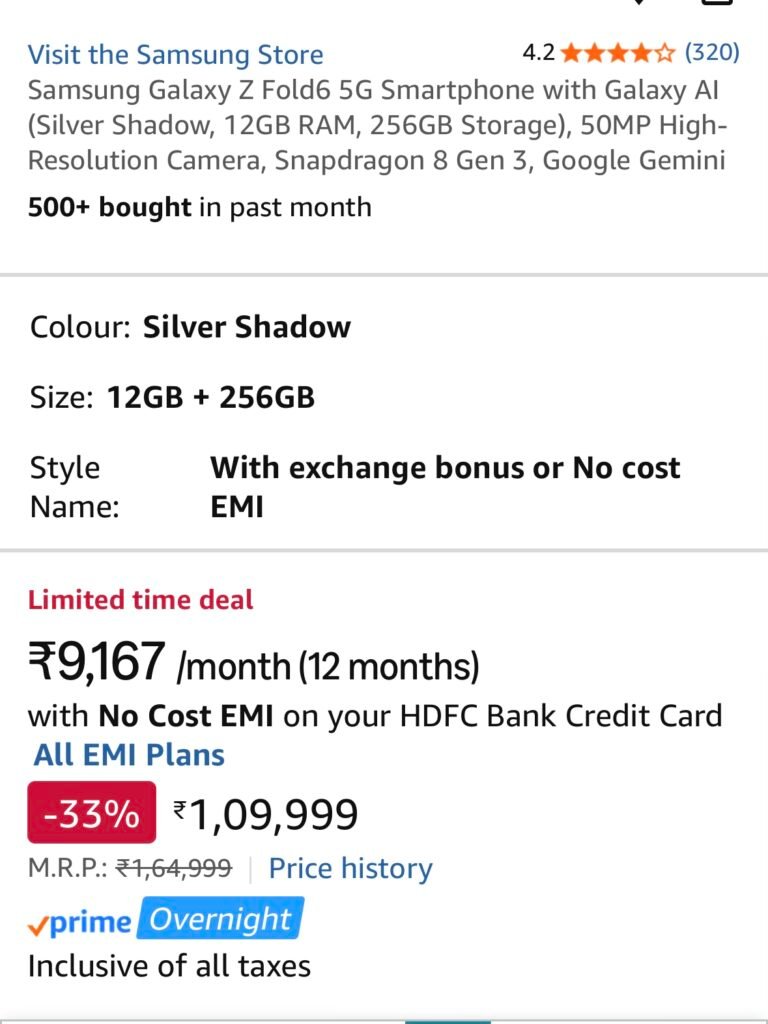

Case 1 : No-Cost EMI without any additional offers

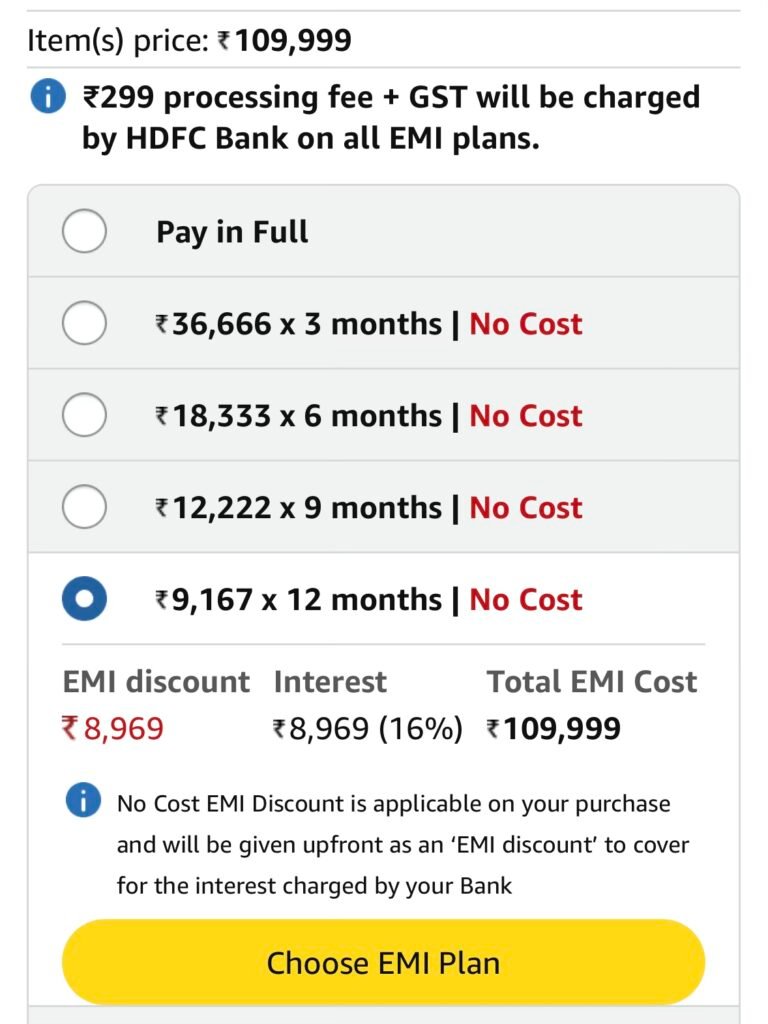

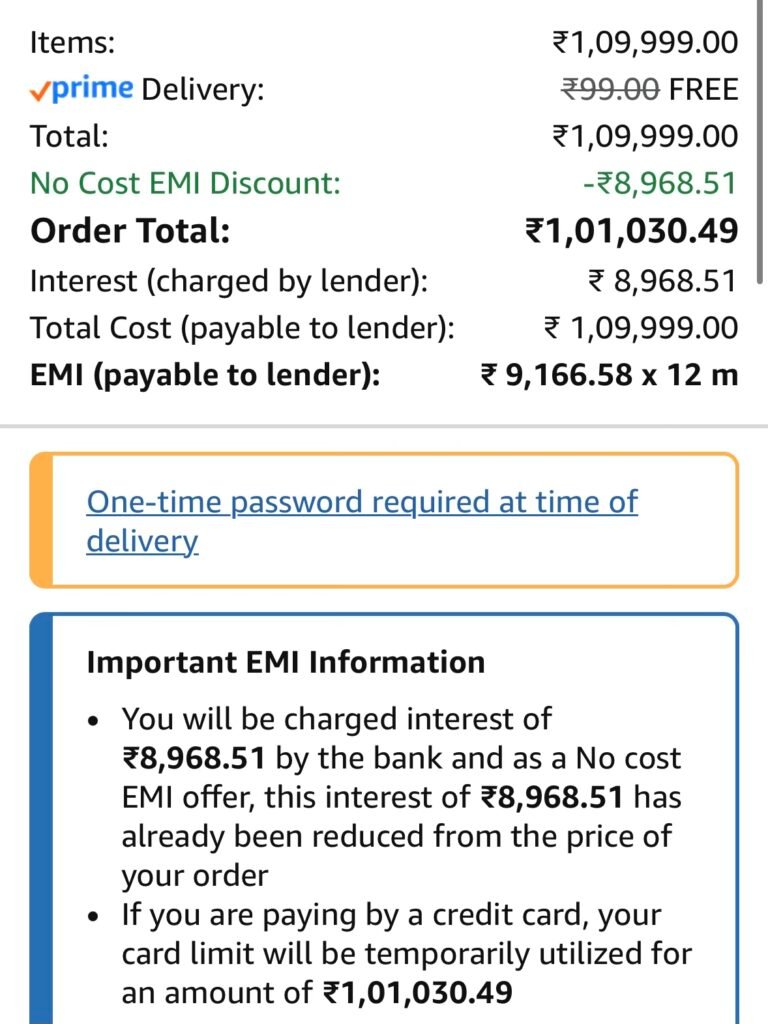

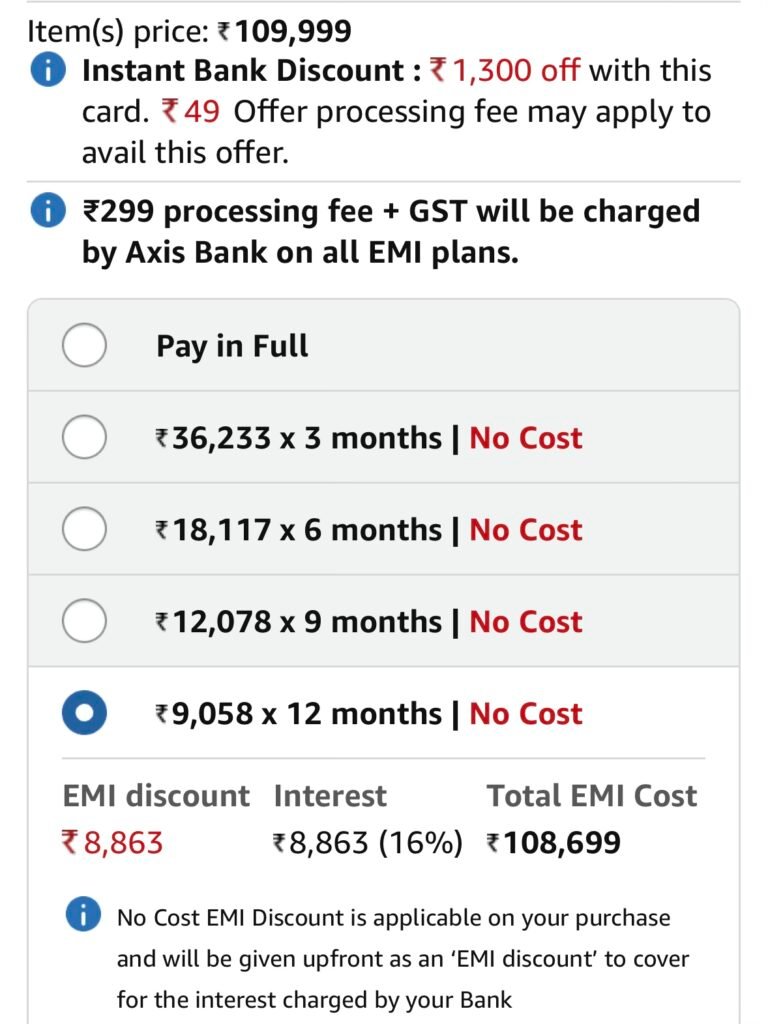

In this case, the product costs ₹1,09,999. If you choose the No Cost EMI option, the seller provides a No Cost EMI discount of ₹8,968, while the lender charges the same amount as interest (see 3rd image).

This keeps the product’s effective price the same as the listed price, hence the term No Cost EMI.

At the time of payment, you pay ₹1,01,030, which is then converted into 12 EMIs of ₹9,166, adding up to the original cost of ₹1,09,999. These EMIs already include the interest component that was adjusted upfront as a discount.

(I’ve chosen a 12-month EMI plan for this example. Since the interest is effectively getting waived off through an upfront discount, it makes more sense to keep the tenure as long as possible.)

Up to this point, you might think, what more could you ask for, you get to pay the same amount over a longer period instead of making a single upfront payment.

However, that’s not the full picture. You must pay close attention to the additional costs that are often overlooked:

- One-time processing fee:

₹299 + 18% GST = ₹352.82 (visible in the second image) - GST on interest: Yes, you must pay GST on all interests charged on credit cards.

Interest amount = ₹8,968

GST @ 18% = ₹1,614.24

Total extra cost paid = ₹1,966

So, despite opting for a No-Cost EMI, you actually end up paying ₹1,966 more than the product’s original price once all charges are accounted for.

Case 2 : No-Cost EMI with additional discounts

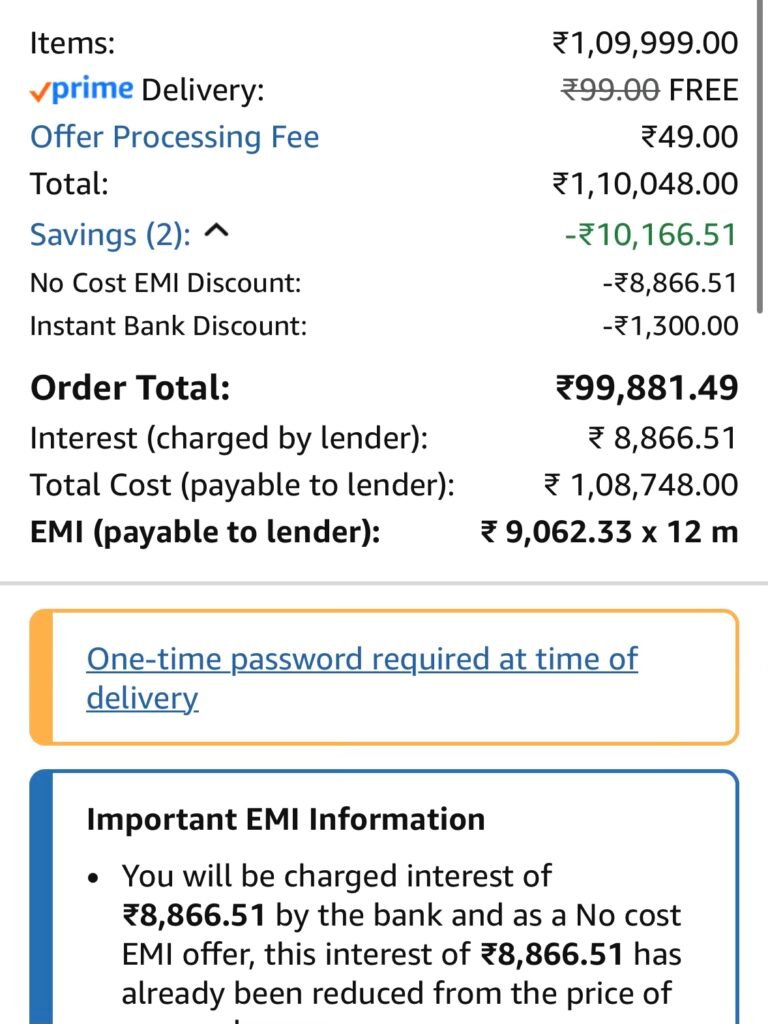

In this case, the product costs ₹1,09,999, and the bank is offering an additional ₹1,300 discount for No-Cost EMI payment with an offer processing fee of ₹49, resulting in an effective discount of ₹1,251.

Here if you choose the No-Cost EMI option, the seller provides a No-Cost EMI discount of ₹8,866, while the lender charges the same amount as interest. At the time of payment, you pay ₹99,881, which is then converted into 12 EMIs of ₹9,062, totaling ₹1,08,748 over the year.

Total additional cost in this case which is not shown in the calculation:

- One-time processing fee

₹299 + 18% GST = ₹352.82 (visible in the second image) - GST on interest

Interest amount: ₹8,866

GST @ 18% = ₹1,595.88

Total extra cost paid = ₹1,948

So, in this case, while you receive an effective discount of ₹1,251, the additional charges amount to ₹1,948, meaning you still end up paying ₹697 more overall despite the No-Cost EMI offer.

Missing Link:

From these two examples, it’s clear that if you manage to get an additional discount equal to the extra costs involved, then opting for a No-Cost EMI becomes a no-brainer.

But….!

And this is a big BUT.

There’s another important aspect you must pay attention to, especially since our focus is on making the most of our money.

Credit cards do not offer any rewards on EMI transactions, including No-Cost EMI.

This brings us to the opportunity cost of earning rewards, which can vary significantly based on your overall credit card strategy.

For example, if you take the simplest way and use Amazon Pay ICICI Bank Credit Card, you earn a flat 5% cashback, which works out to ₹1,09,999 × 5% = ₹5,500 (approximately).

If you use the SBI Cashback Credit Card and manage to buy Amazon shopping vouchers at a 1.5% discount (for example, via platforms like CRED), your effective return becomes 6.5%, which translates to ₹1,09,999 × 6.5% ≈ ₹7,150.

If you hold premium credit cards, the opportunity cost can be even higher. With effective reward rates of 10–15%, you could earn anywhere between ₹11,000 and ₹16,500 in value on the same transaction.

This is the reward potential you give up when opting for No-Cost EMI, since EMI transactions do not earn any rewards.

Final Verdict:

If the main reason for choosing an EMI is that you can’t afford to pay for the product upfront but still need it, a No-Cost EMI can be a saviour. It helps you avoid the high interest rates associated with personal loans or regular credit card loans.

However, if you can afford to pay the full amount upfront, you should carefully consider all associated costs, including the reward potential you forgo by opting for a No-Cost EMI. In many cases, paying in full and earning rewards may turn out to be the better financial decision.